Market Report for Week of January 11th, 2016.

So the market in January 2016 is off to the “worst start in history” thus far. There have only been 5 trading days in 2016 and the SPX (which closed 2015 at 2044) is at 1922 down -5.9% in the first 5 trading days of the year.

As I pointed out last week, 2015 wasn’t a good year for many stocks, especially small caps. Friday, the Russell 2000 (IWM) closed at a 52-week low and is down an astounding -19.5% from it’s high in June. The small caps are probing bear market territory. It’s no wonder the market has felt so “rough” recently.

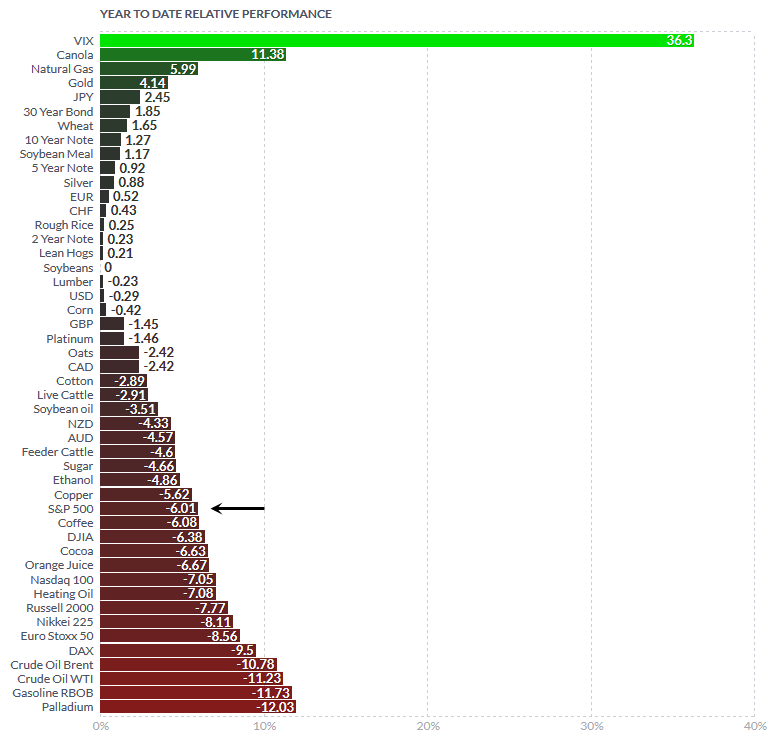

Here’s where everything stands year to date – one trading week into the New Year. Note the S&P Futures vary slightly from the actual SPX index.

Much of the recent “turmoil” is being blamed on China. It seems to be a combination of a slowdown in the Chinese economy, big drops in their stock market, and a devaluation of their currency, the Yuan. These are sort of the standard narratives being attributed to why our market just fell so hard.

Personally I think a bit of the selling might just be due to the fact that waiting until the New Year to sell postpones having to pay taxes on gains all the way out into April 2017. In other words, tax-loss selling was for the end of 2015. Harvesting (perhaps multi-year) gains is perfect at the start of a new year for tax purposes.

Why would “they” start selling and locking-in multi-year gains now? Well the writing has been on the wall for a while. It’s clear the domestic and global economy aren’t exactly robust. The IMF just lowered their World GDP forecast last week. Deutsche Bank, cut their Q4 GDP forecast to just 0.5% for the 4th Quarter. The warm weather must have screwed everything up.

But seriously it’s been clear for some time that we’re in a sort of “industrial recession” both here and abroad and plunging commodity prices were the clue. That and Caterpillars revenue and earnings among other industrial companies. Plunging oil and commodity prices mean all is not well in the real world. Add to that the retail sector which has been dropping for some time now as consumers take to Amazon for their shopping more and more. Think of the overcapacity of bricks and mortar retailer out there, all the malls and strip plazas.

Last year one narrative repeated over and over by financial professionals was “low gas prices are good for the consumer”. That may be true to a point but the reality is that healthcare and increases in the price of food likely took that savings. I have a hard time believing that “business was great” for the majority of retailers in the 4th Quarter, other than Amazon.

The sentiment is terrible right now and the market is oversold. There’s a big bounce coming.

That doesn’t mean the very first rally will carry or that we haven’t seen the lows yet. As bad as last week was it didn’t quite feel like “capitulation” which often signals a near-term low. It’s possible the market calms down and stabilizes then bounces and it’s possible the market has a down-then up “reversal day” and rips higher.

Last August was the most recent period of time to look back to for clues. The low was marked by a Flash Crash. Then the market bounced for a while and came back to retest the lows before moving higher. It’s hard to tell what this week brings but a lot of people are watching for that “capitulation low” so it might not happen that way. If it does it will be terrifying to try to buy into it anyway.

As bad as the action was last week I wanted to take an attempt at a trade because if you don’t “take a shot” then you’ll miss the inevitable rally. Fortunately the damage was minimal and we took a -4.2% stop-out on PAYC. In the big scheme of things that’s like walking away from an accident with a stubbed toe. Anyone that wasn’t prepared to get stopped-out of open positions is in a lot of pain at this juncture. Individual stocks got crushed.

I can only imagine typical “investors” are sitting on huge percentage losses, even in “quality names” if they didn’t choose to use stops. So the damage has been done and the big question here is how much more is there?

Well we are headed into earnings season and as of Jan 8, Q4 S&P 500 EPS are expected to drop -5.3%. You would think much of that is energy-related but 6 out of 10 S&P sectors are expected to see earnings declines. “Earnings drive the market” is a common saying so that doesn’t bode well unless things turn around in the next Quarter or two. If it weren’t for stock buybacks the market probably would be faring even worse.

All in all it’s difficult to be optimistic overall at this juncture (from a longer-term perspective) but there is likely a big oversold bounce on the horizon.

It’s the Monthly chart that scares me the most. Look at the MACD configuration on the Monthly timeframe.

I pointed out the MACD cross last year when it happened, but it’s the “spreading apart” of the signal lines that should make you stand up and take notice.

All in all, unless the market can somehow rally back up and make new highs, the Monthly timeframe looks like a topping process is underway and I can’t ignore the similarities between the prior major tops as far as the MACD. The key thing to watch going forward – and we are talking about a Monthly timeframe here – is the 10-month moving average crossing down below the 30-month. That was the indicator I used back in 2008 to warn the members.

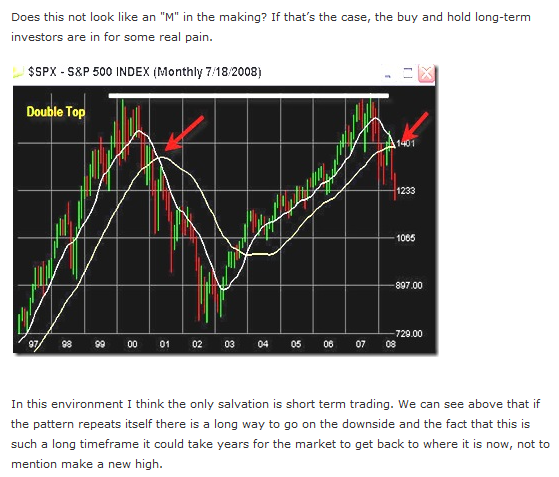

I did my very first Market Report to members in July of 2008 and posted this chart.

See the 10-Month moving average beginning to cross the 30-month? The SPX lost almost half it’s value after I posted that back in 2008. Keep an eye on those moving averages going forward.

It could manifest differently this time and “they” might still be able to pull things together somehow but the longer-term technical picture isn’t constructive at all – at this juncture. Again, this doesn’t mean there’s not a HUGE RALLY this week or next week or the one after that.

When I post a monthly chart it’s big picture stuff and you have to be able to separate looking at the forest from looking at the trees.

So here’s how this works. Everyone is all bearish right now – with good reason. Things get a little worse, maybe we drop down to the August lows, maybe a bit further. Or maybe we get that rally sooner rather than later.

You look at my Monthly chart and think “he’s all bearish” and then we get that rally I know is coming. Maybe even for a couple months the market starts acting better. But like I’ve been saying for weeks here, the market needs to “prove” itself by making a NEW ALL-TIME HIGH before the technical picture turns constructive again. The possibility exists that the high last May could stand for a long time. Things could get worse before they get better.

Maybe the Fed will save things like they’ve done so many times in recent history.

With that said, I’m ready to trade the inevitable forthcoming rally and I’ll be ready to jump right in and take some shots this week. Certain individual stocks are way overdone to the downside and once traders see the first sign of a decent rally they will be jumping right in for a quick trade. That’s the key here. It’s all about the “quick trade” and avoiding the false rally where it looks like it’s safe to get back in the water and then they pull the rug out again. The first round of dip buyers tend to get stopped-out and we saw that exact type of price action Friday.

“Fear of missing out” (FOMO) almost seems as prevalent as the fear of losing money these days and leads to wild gyrations in the market short-term. Bear market rallies tend to be more dramatic than normal rallies in an uptrending market.

It’s going to be tricky but I’m positive there will be some good opportunities this week. It will be all about minimizing risk and using tight stops. As far as initiating longer-term positions I’d probably wait for the dust to settle a bit.

But I think this is going to be an action-packed week headed into earnings. The key will be to find the stocks that are getting bought and determining where the money is flowing. Just about every stock got caught up in the selling but there will be certain stocks due rally big anytime now. As always I’ll be watching every stock in the market and gauging the action to try to find the right stocks to play.

You can’t win if you don’t play and you don’t want to chase the next rally after it’s moved too far off the lows. I want to try to get in as close to the pivot lows as possible so i can use a tight stop. The further a stock pulls away from the low the riskier it is to chase.

There will be opportunities and while I’ll start off the week with some patience, I expect to get in there and catch some quick trades at the right time. As I find them I’ll bring them to you on the shows, in the Chart Feed, Focus lists and by email when I find the right ones.

Please join me for the live shows this week and we’ll work with whatever the market decides to do.

See you there!